What Are Ui Gross Wages

The purpose of this worksheet is to assist you in properly reporting your gross wages and hours worked while filing for ui benefits.

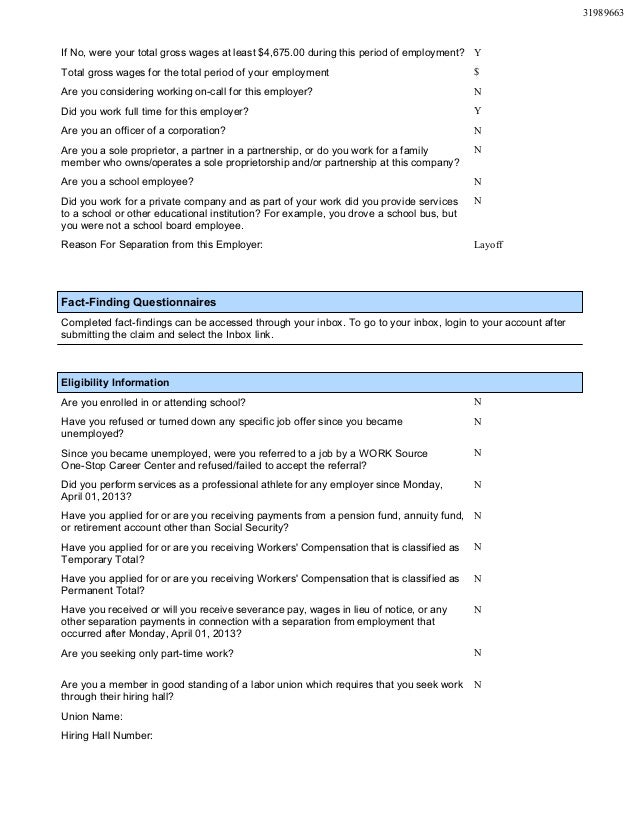

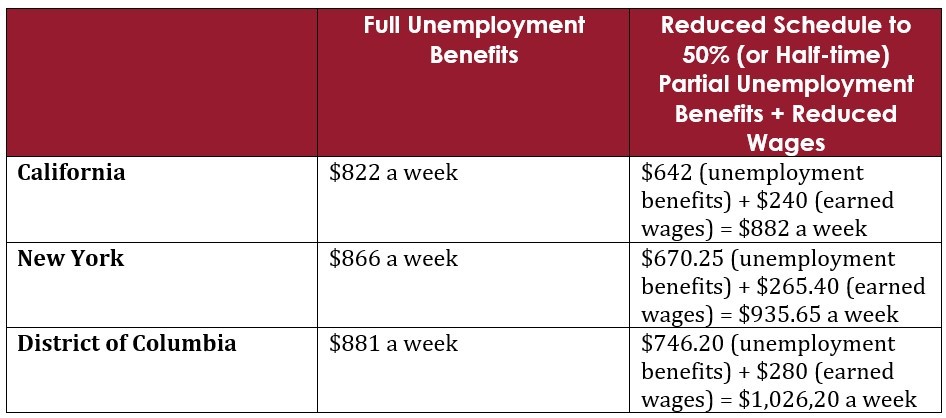

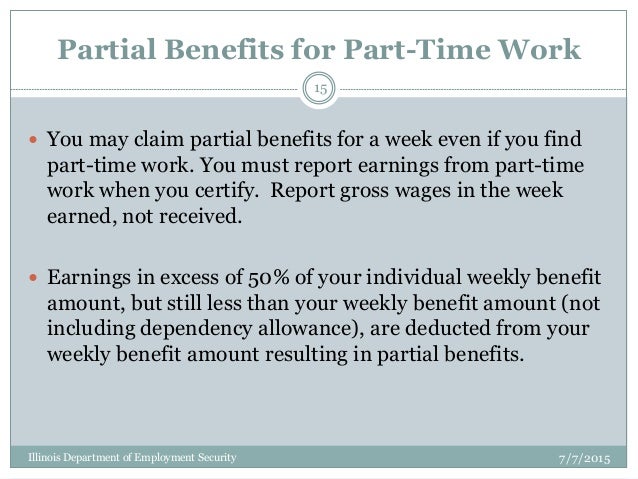

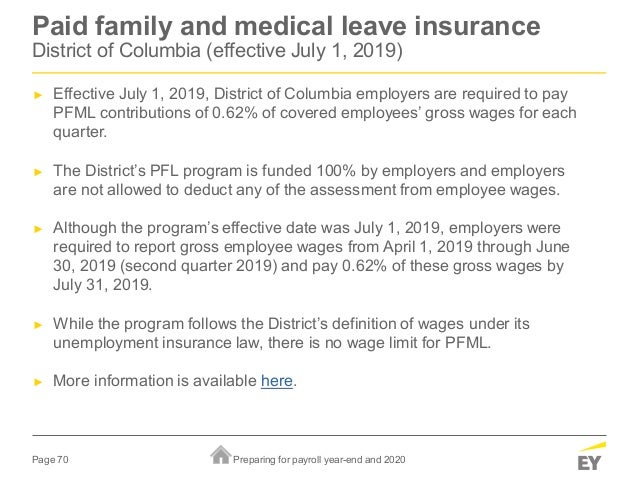

What are ui gross wages. Net and gross pay when you file for unemployment benefits you must report your gross earnings which is the total wages earned before deductions such as federal state and local taxes insurance pensions 401 k and miscellaneous deductions such as union dues. Commonwealth of massachusetts ui liable employers pay a quarterly ui contribution based on gross wages paid to each employee up to the contributions usable wage base for that year. What are gross wages. Ui gross wages are required in order to pay benefits.

Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. 3 only a portion of employee a s fourth quarter wages are used to determine the sdi taxable wages. In addition during times when the ui trust fund balance falls below a specified level the sui wage base could increase to 11 000 or 12 000. Because an eligibility period may extend more than a year into the past determining the gross wages can mean tracking payments made from multiple sources.

In this article we ll provide more details about what gross income is what it means for your monthly and annual income and how to properly calculate your income. 2013 legislation hb 168. The contributions are deposited into the federal unemployment trust fund on behalf of the commonwealth of massachusetts which is used to pay unemployment benefits to eligible applicants who are unemployed. Prior wages reported plus 20 880 mean that employee a has reached the sdi taxable.

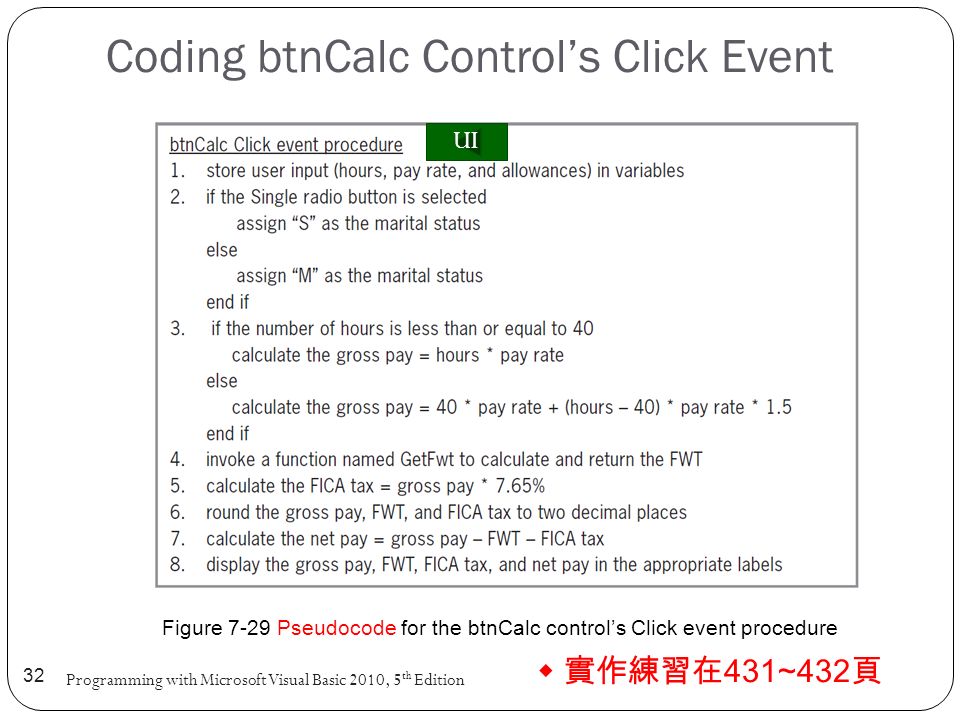

Please keep in mind that failure to. For example if you made 10 per hour and worked 20 hours a week your gross wages would be 200 00 for that week. You can calculate an employee s gross pay for different periods of time. For a worker a gross wage is simply everything earned during the period before the removal of taxes or any special payments.

To figure out what your gross monthly earnings are take your hourly pay and multiply that number by the number of hours that you work in a week and then multiply by 4. Depending on the ui benefit rate the sui wage base could range from 7 000 to 10 000. You will normally calculate an employee s gross pay for your pay period. If you perform work and file for benefits during a given week this worksheet can be very helpful in calculating the amount to report and also serve as a reference document if questions about your reported earnings later arise.

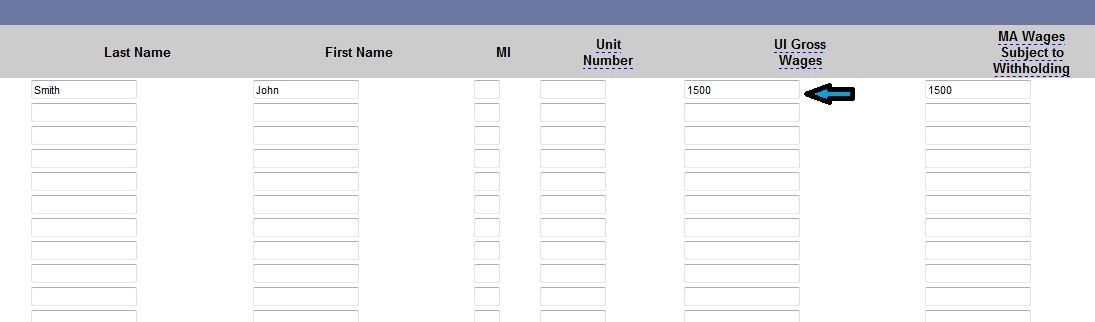

Wage reporting for reimbursable employers you must enter ui gross wages in addition to wages subject to withholding. Gross wages are the total amount you pay an employee before you withhold taxes and other deductions. The unemployment office looks at your gross wages when considering you for unemployment benefits. For example when an employer pays you an annual salary of 40 000 per year this means you have earned 40 000 in gross pay.

Because of payroll withholdings an employee s take home pay can be significantly less than their gross wages. But you can also calculate gross pay annually quarterly monthly daily or for any other period of time.